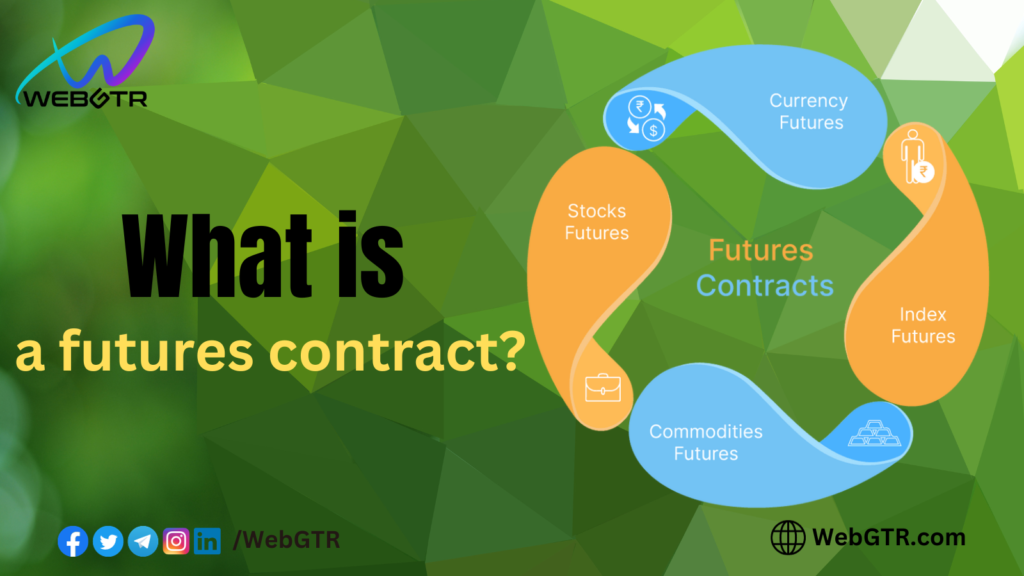

A futures contract is a pact to buy or sell a commodity, currency, or another instrument at a predetermined price and time in the future.

Unlike the immediate settlement in a traditional spot market, futures market transactions are not instantly resolved. Instead, two parties engage in a contract, outlining settlement terms for a future date. Moreover, a futures market doesn’t facilitate direct buying or selling of the underlying commodity or digital asset. Participants trade contracts representing these assets, with the actual exchange of assets (or cash) occurring in the future when the contract is executed.

For instance, consider a futures contract for a physical commodity like wheat or gold. In some traditional futures markets, these contracts involve physical delivery of the commodity, incurring additional costs such as storage and transportation (known as carrying costs). However, many futures markets now feature cash settlements, where only the equivalent cash value is exchanged, eliminating the physical exchange of goods.

Additionally, the price of gold or wheat in a futures market may vary based on the contract settlement date. The longer the time gap, the higher the carrying costs, the greater the potential future price uncertainty, and the more significant the price discrepancy between the spot and futures market.

Looking for Blockchain Development, NFTs, Website Design, Token Creation, or Other services? Reach out to us at WebGTR. Let’s discuss and bring your vision to life.

Leave a Reply